35+ how does mortgage forbearance work

All your monthly mortgage payments are temporarily paused. During the time that you are not making payments or are making reduced payments interest will still accrue on the loan.

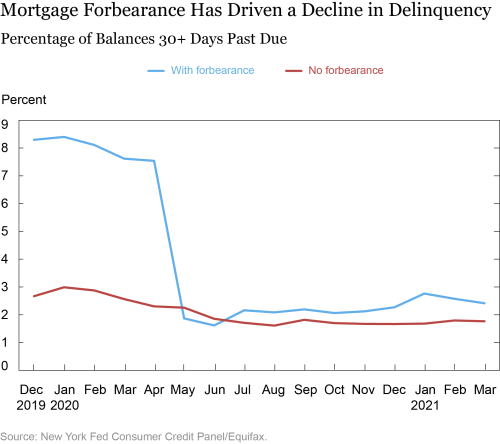

What Happens During Mortgage Forbearance Liberty Street Economics

This means reducing your payments or suspending them entirely.

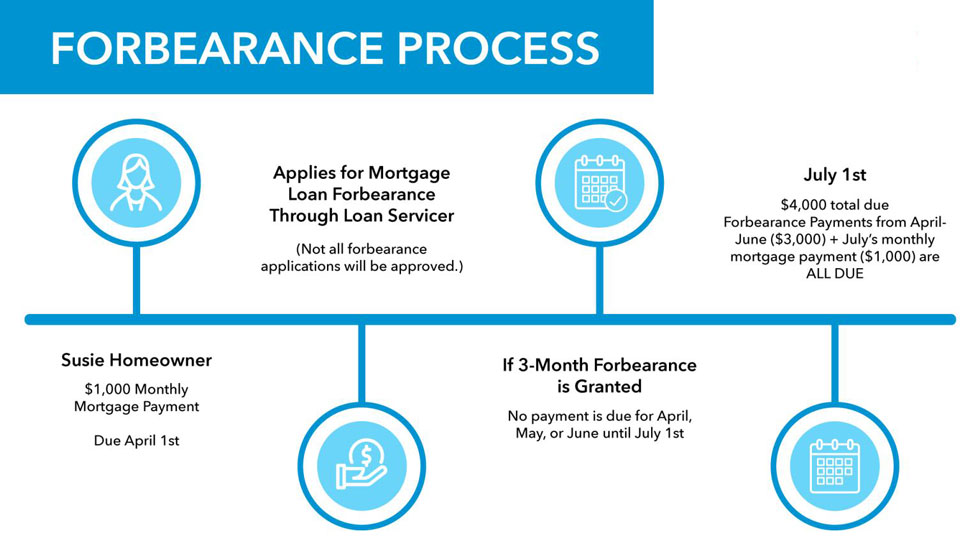

. Web Generally speaking it is an agreement between you and the bank that allows you to make no mortgage payments at all or reduced mortgage payments for a specific period. Web The mortgage forbearance process could be as simple as filling out a form on your lenders website while other mortgage providers may require a phone or in-person consultation. In some cases such as with certain mortgages forbearance might result in a reduction in the payment amount rather than a complete suspension of your payments.

Web In effect mortgage forbearance refers to the process of temporarily pausing or lowering payments on an outstanding mortgage. Web A mortgage forbearance agreement is made when a borrower has a difficult time meeting their payments. Web Forbearance is the agreement to pause your mortgage payments and deferment is to put off your payments for a temporary period.

Web Mortgage forbearance provides temporary relief by allowing you to make lower monthly payments or no payment at all for a specific period of time. Forbearance is not automatic. Before you miss any mortgage payments you should talk to your lender about mortgage relief options.

Typically borrowers ask lenders for forbearance. During the time of forbearance your loan. Web Mortgage forbearance provides homeowners a way to temporarily pause or lower mortgage payments when facing financial setbacks.

It happens when the lender grants the borrower momentary relief from paying off their debt due to hardships such as unemployment injuries illnesses or natural disasters. With the agreement the lender agrees to reduceor even suspend entirelymortgage payments. Web Forbearance is a term that refers to the temporary reduction or postponement of payments such as for loans or mortgages.

Experiencing a temporary hardship. Web Forbearance is a way for those facing financial hardship such as a job loss or medical crisis to avoid going into default on their loans. Web Forbearance is when your mortgage servicer thats the company that sends your mortgage statement and manages your loan or lender allows you to pause or reduce your payments for a limited period of time.

You must request it from your mortgage servicer. During this time interest will accrue on your missed payments. Web For homeowners who cant afford the regular monthly payments after forbearance they can extend their mortgage term to 360 months which will reduce the monthly principal and interest payments.

If you lose your job or have some other type of financial hardship making ends meet can be difficult. Mortgage forbearance is a temporary relief of your mortgage payments by pausing your payments for a specific period or pausing certain portions of your payments. It occurs when your mortgage servicer or lender allows you to pause or reduce your payments for.

Youll have to repay any missed or reduced payments in the future. Your loan servicer must approve both situations and if you dont meet the requirements and make your payments on time after the agreements end you could end up in foreclosure. The terms of forbearance can also vary depending on what type of loan you have but you will usually.

The lender temporarily reduces your monthly mortgage payments. Behind on your mortgage payments or on the verge of missing payments. Web Forbearance is when your mortgage servicer or lender allows you to pause or reduce your mortgage payments for a limited time while you regain your financial footing.

In the case of the CARES Act the period is 180 days and could be extended by more than 180 days. Web Mortgage forbearance allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis such as a job loss illness or other financial setback. Mortgage forbearance is for homeowners who are or will be delinquent on their mortgages due to a temporary financial hardship though lenders each have their own policies and terms for how they handle it.

Web Designed for borrowers who are facing financial hardship mortgage forbearance is one tool lenders and mortgage servicers can use to help homeowners ease their financial burden in order to. Web How Does a Mortgage Forbearance Work. Web Forbearance may be an option if you are.

Web Forbearance is a temporary modification of your payment obligations on a loan. Forbearance does not erase what you owe. Web What Is Mortgage Forbearance.

Web The two main types of mortgage forbearance are. Gather your financial information Make sure you have your basic financial and loan information on hand when you call your mortgage company.

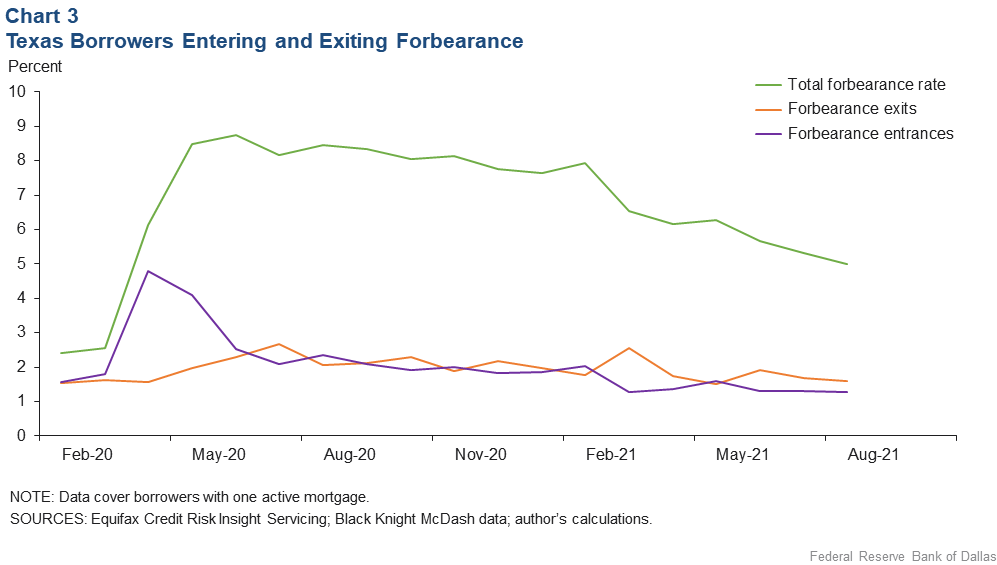

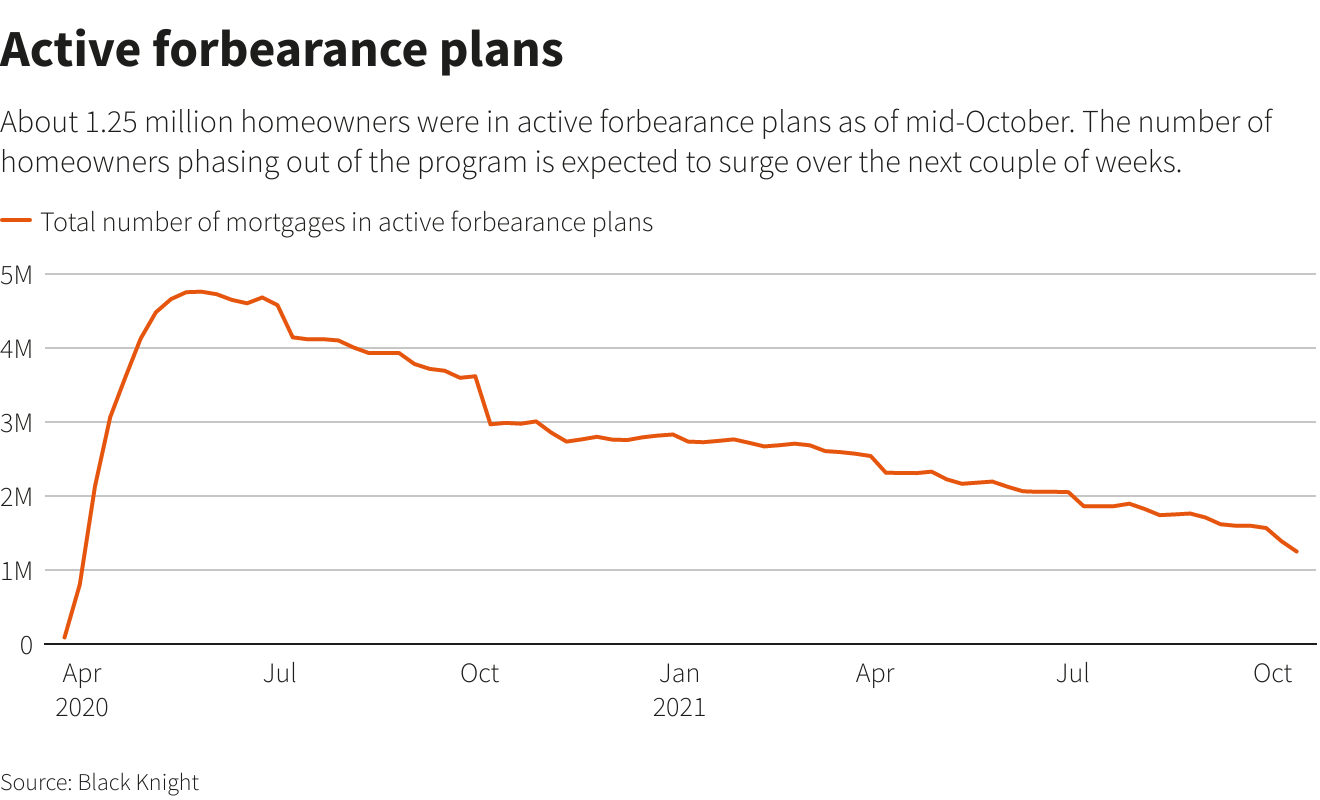

Pandemic Mortgage Relief Headed Off Delinquencies But What Happens Now Dallasfed Org

Learn About Forbearance Consumer Financial Protection Bureau

What To Expect After Mortgage Forbearance Ends

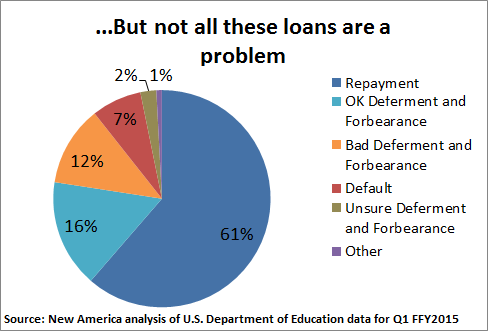

A Closer Look At Student Loan Deferment And Forbearance

Article

Six Facts You Should Know About Current Mortgage Forbearances Urban Institute

Vulnerable U S Homeowners Face Uncertainty As Mortgage Forbearance Ends Reuters

Mortgage Forbearance Reaches Close To 7 Mortgage Bankers Association Survey

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MR7FMYCQI5OM7EQOUDQVGZCQ2M.png)

Vulnerable U S Homeowners Face Uncertainty As Mortgage Forbearance Ends Reuters

Cfpb Report Many Borrowers Still Behind On Mortgage Payments After Covid 19 Forbearance Fox Business

Requesting Mortgage Forbearance Be Careful Greenbush Financial Group

Student Loan Forbearance A Definition And Overview Mintlife Blog

Forbearance And How It Affects You

What Homeowners Should Know About Mortgage Forbearance Bankrate

What Is Loan Forbearance Lexington Law

What Is Mortgage Forbearance Rocket Mortgage

Mortgage Forbearance Ending Options For Homeowners Bankrate